Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

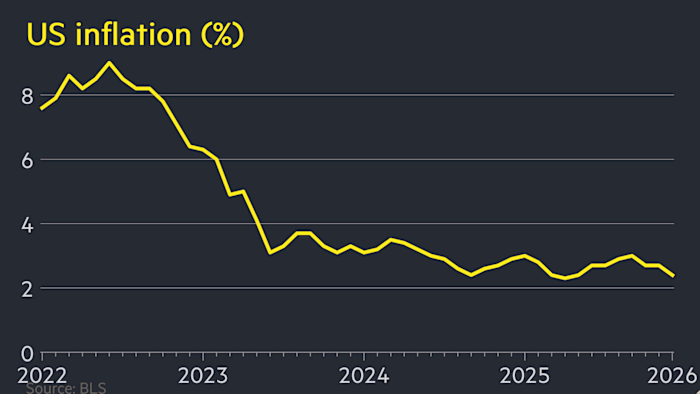

US inflation fell more than expected to 2.4 per cent in January, prompting investors to inch up bets on interest rate cuts from the Federal Reserve as price pressures ease in the world’s biggest economy.

Friday’s figure from the Bureau of Labor Statistics was down from a year on year pace of 2.7 per cent in December and below the 2.5 per cent expected in a Bloomberg poll of economists.

A drop in petrol prices and a deceleration in housing-related costs helped to temper the number. Core inflation, which strips out volatile food and energy prices, fell to its lowest level in almost five years.

Eswar Prasad, an economist at Cornell University, said the combination of the relatively low inflation figures and strong jobs data earlier this week had “a whipsaw effect on expectations of rate cuts, giving both doves and hawks” in the Fed scope either to cut rates or keep them on hold.

The yield on two-year Treasuries, which tracks interest rate expectations, fell modestly on Friday’s data, down 0.05 percentage points to 3.41 per cent.

Traders in the futures markets briefly increased bets on a third interest rate cut this year, moving the odds to 50 per cent, before returning to roughly 40 per cent.

“I don’t think this gets the Fed to move any faster,” said Jonathan Hill, head of US inflation strategy at Barclays. “We’re getting mixed signals from the data.”

Friday’s data showed that core inflation fell to 2.5 per cent, its lowest level since March 2021. That was in line with Wall Street expectations and down from 2.6 per cent in December.

Housing-related costs — which make up about a third of the index and had helped keep overall inflation levels elevated in recent months — rose at an annual pace of 3 per cent in January, down from 3.2 per cent the previous month.

Economists welcomed the lower inflation figure, but cautioned it was still distorted by last year’s government shutdown, which prevented the BLS from carrying out its surveys and left a gap in the data.

“It’s better news than we expected,” said Diane Swonk at KPMG. “[But] some of it may be due to the data being still not as clean as we’d like, so we don’t want to jump to too many conclusions, which is why the Fed is in wait-and-see mode.”

The release comes after the Fed held rates at a range of 3.5 per cent to 3.75 per cent in January, following three straight quarter-point reductions, with chair Jay Powell pointing to a stabilisation in the labour market.

The employment figures released on Wednesday showed the economy added 130,000 jobs last month, almost double economists’ forecasts, in an indication of regained momentum following a string of bleak data.

“We continue to expect two cuts this year, with the next move coming in June,” said Lindsay Rosner at Goldman Sachs Asset Management, emphasising that the Fed’s room for manoeuvre will largely depend on the health of the labour market.