Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

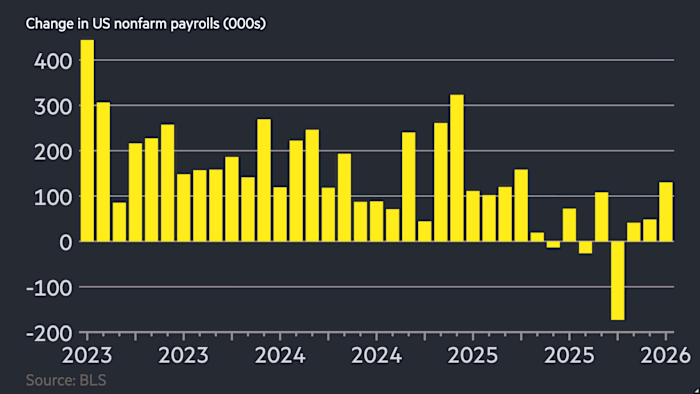

Donald Trump’s policies will expand the federal budget deficit by $1.4tn over the coming decade, Congress’s fiscal watchdog has warned, driving up public debt and leaving government finances on an unsustainable path.

The Congressional Budget Office on Wednesday raised its estimate of cumulative deficits through 2035 by 6 per cent, compared with a previous forecast last January, following the implementation of the president’s sweeping tax and spending bill and his immigration policies.

It said the annual deficit would rise from $1.9tn this year to $3.1tn by 2036, pushing federal debt levels beyond their second world war record as soon as 2030.

“Our budget projections continue to indicate that the fiscal trajectory is not sustainable,” said CBO director Phillip Swagel.

The warning from the CBO, a non-partisan agency that sits within the legislative branch of government, will add to already heightened investor concerns about the scale of the US debt pile.

“There’s no sugarcoating it: America’s fiscal health is increasingly dire,” said Jonathan Burks at the Bipartisan Policy Center. “Our debt is now 100 per cent of GDP, and rather than pumping the brakes, we are accelerating.”

The 2025 One Big Beautiful Bill Act, the president’s flagship fiscal law, which extended tax cuts from his first term, will increase deficits by $4.7tn by 2035, the CBO said on Wednesday. The administration’s crackdown on immigration will add a further $500bn.

The rise will be offset in part by revenues from the president’s tariffs on trading partners, lowering overall deficit levels by about $3tn.

The widening deficits will push debt from 101 per cent of GDP this year to 108 per cent by 2030, eclipsing the previous high of 106 per cent in 1946 in the wake of the second world war. By 2036 it is set to reach 120 per cent.

The US government debt market is five times the size it was in 2008, and investors have long been worried that the supply of Treasury debt is straining the limits of demand.

The scale of debt on offer has hit prices and helped lift yields on the benchmark 10-year Treasury note, which sets the rate at which the government borrows money, as well as mortgage rates. The Trump administration, intent on lowering the deficit and making housing more affordable, has expressed a desire to lower long-dated Treasury yields.

“The fiscal trajectory of the US still needs some fixing in the longer run,” said Gennadiy Goldberg, head of US interest rates, TD Securities. “The CBO’s estimate will add to the narrative that the US fiscal picture is unsustainable.”

Other analysts warned that the extent of the borrowing would leave the US unable to take adequate steps in the face of any unexpected downturns.

“A healthy balance sheet is critical for a growing economy, national security and the ability to respond to unforeseen emergencies,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

“With debt around 100 per cent of GDP and growing, we will enter the next crisis with a higher debt-to-GDP ratio than we ever have had before.”

Goldberg at TD Securities cautioned that significant uncertainty remained around tariffs, with a pending case before the Supreme Court set to determine the legality of many of the president’s levies.

“A lot of these numbers could also change significantly depending on the outcome . . . I think the CBO is making their estimate in a really uncertain environment,” he said.